- Reg52

- Posts

- UK FIU SAR MLRO takeaways + AUSTRAC Entain 640pg AML mega doc

UK FIU SAR MLRO takeaways + AUSTRAC Entain 640pg AML mega doc

NCA. AUSTRAC. OFSI.

FCC MWF

A single line from the 640 pages AUSTRAC launched in their Statement of Claim against Entain (owner of Ladbrokes)

Good morning ,

Main Story: My top 3 MLRO takeaways from UK FIU SAR Report

Enforcement Actions & Fines: Austrac releases mega (640 page) doc outlining AML claims against Ladbrokes owner Entain

Regulatory Updates: Iran focus + OFSI Legal Threat Assessment

1. Main Story: UK FIU SAR Annual Report 2023/24

🇬🇧 United Kingdom | NCA

The NCA released the UK FIU SAR Annual Report 2023/24 last week. Below are my top three takeaways for MLROs - please feel free to chime in with objections/improvements.

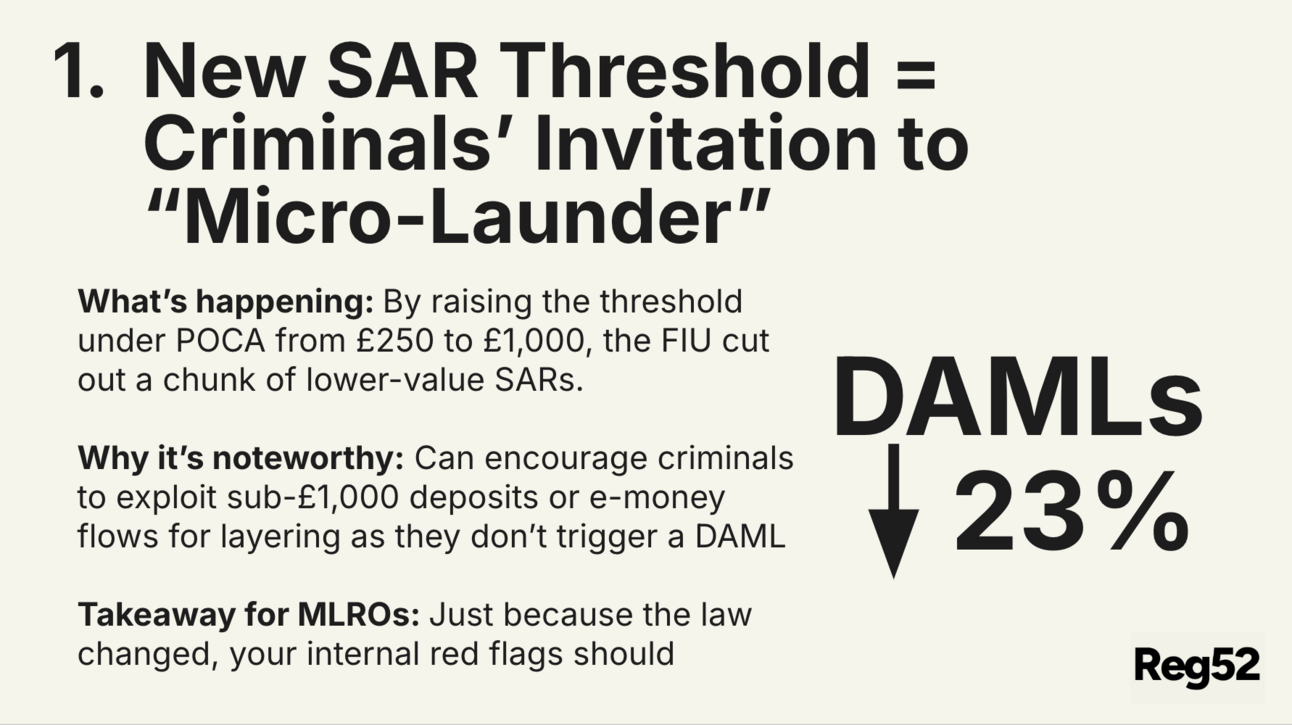

New SAR Threshold = Criminals’ Invitation to “Micro-Launder”

What’s happening: By raising the threshold under POCA from £250 to £1,000, the FIU cut out a chunk of lower-value SARs.

Why it’s noteworthy: Can encourage criminals to exploit sub-£1,000 deposits or e-money flows for layering as they don’t trigger a DAML

Takeaway for MLROs: Just because the law changed, your internal red flags should

The change in SAR threshold is brought up multiple times throughout the report and is probably the single biggest change from the previous year’s approach.

Extended Moratorium periods now the norm… with benefits

Due to extended moratorium periods

What’s happening: Increased use of moratorium extensions on DAMLs. Investigations now stretch well beyond the 7-day notice period—leading to multi-week (even multi-month) limbos.

Why it’s noteworthy: Banks are caught in the middle, dealing with frozen accounts, anxious clients, and repeated info requests.

Takeaway for MLROs: You’ll likely face more iterative back-and-forth with the FIU and the customer. Prepare bulletproof audit trails

Terrorist Financing “One Big Hit” Trend: Fewer SARs, But Bigger Individual Values

What’s happening: DATF (Terrorist Finance) SARs are still a fraction of total filings (406 DATFs out of 872k total), but single large-value refusals are cropping up—incl. a £1.7M refusal in 23/24

Why it’s noteworthy: TF typically conjures images of small-scale fundraising. This larger SAR can imply more sophisticated/coordinated terror groups

Takeaway for MLROs: Integrate TF indicators into your high-value alerts, not just lower-level

2. Enforcement Actions, Legal Action & Fines

🇦🇺 Australia

AUSTRAC published their 640 page Statement of Claim against Entain (AUSTRAC)

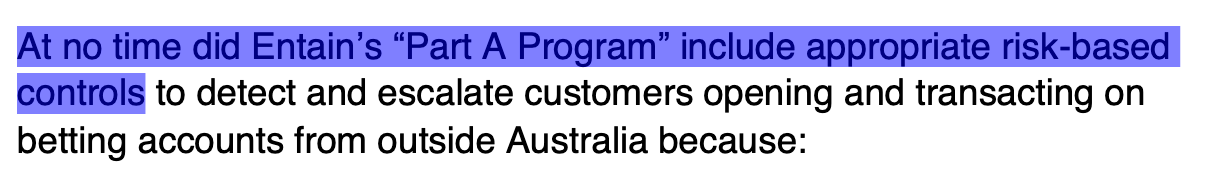

It contains a huge amount of supposed AML failings - including the PEP point above and this risk-scoring point (amongst many others)

AUSTRAC Statement of Claim page 72

I will do a deep-dive of the 640 pages (either next week or week after) and as part of that I will create an Enforcement Action Risk-Based Analysis (likely to be a paid product down the line). I’ve spoken to a couple of you about what this would look like - if anyone else has specific requirements just shoot them over - see initial outline below