- Reg52

- Posts

- My first Insights page! UK Export Settlements cont'd

My first Insights page! UK Export Settlements cont'd

With gif

FCC Deeper Insights

Hi ,

On Wednesday I spoke about the importance of UK approach to export breaches as the potential flag-carrier of Sanctions measures and enforcement going forward.

I also promised a full page that you can use to share insights internally or externally - see gif below with link.

Not the world’s most exciting gif, but useful hopefully

Link to the page above: https://reg52.com/hmrc-export-breaches-2020-to-2025/

Feel free to just go to the page and browse yourself.

Two aspects I would draw your attention to when speaking with ExCo or clients:

Blind spots which HMRC has been penalising firms for

If you’re dealing across UK & US - what’s the difference in enforcement approach to date?

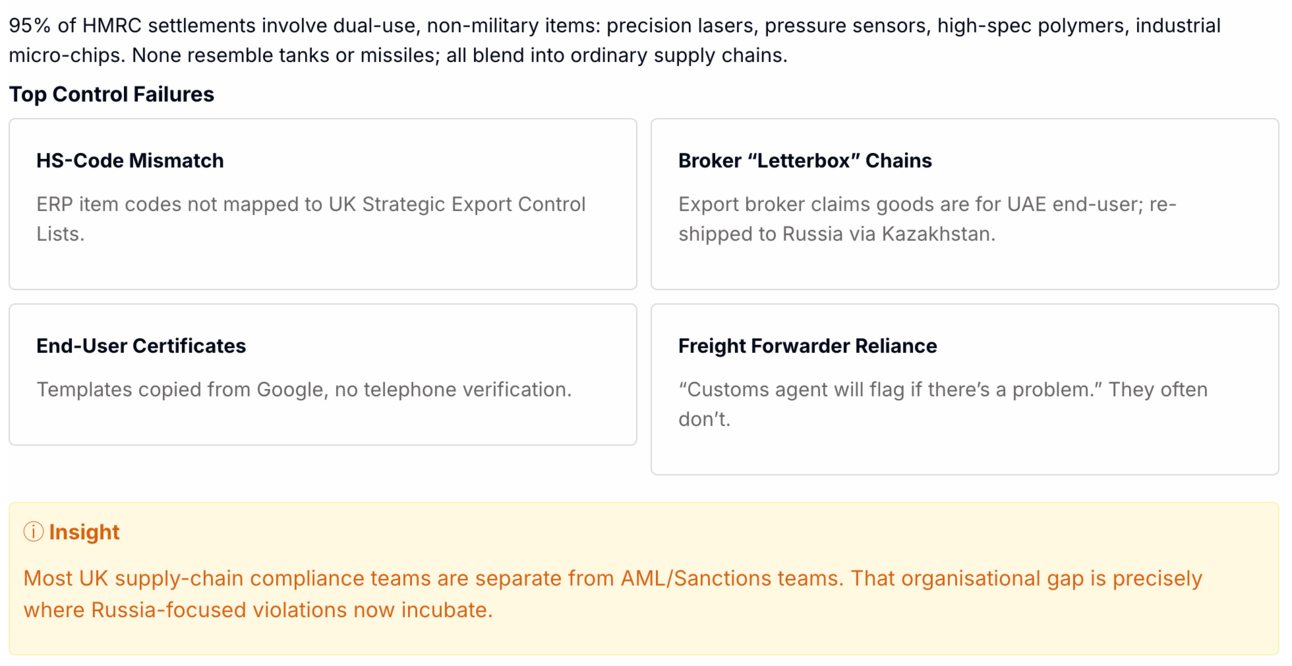

The Dual-use Goods Blind spots

Half-way down the page you’ll come across these blind-spots. The vast majority of HMRC settlements relate to dual-use goods, here’s reasons for the breaches:

If you’re dealing across the UK & US

Here’s a quick way to think about the differentiation (also on the Insights page).

Dimension | HMRC (Trade) | OFSI (Financial) | OFAC (US) |

Domain | Goods, brokering, technical assistance | Funds, economic resources | Both goods & funds |

Core Penalty Tool | Compound settlements (if inadvertent) | Monetary penalty | Civil penalty + criminal referral |

Public Detail Level | Limited (amount only) | Public Notice | 5-ish pages |

Key Trigger for Leniency | Self-disclosure & remediation | Voluntary disclosure & cooperation | "Voluntary Self-Disclosure" + non-egregious |

At the bottom of the Insights page I also included the most relevant Settlement/Enforcement Action links if you want to call out specific cases to mgmt.

I’ll be back on Wednesday, have a good long weekend!

Paul

If you found today’s email this helpful, please share with one fellow AML Leader, thanks.

They can sign up at the top of the page here: https://reg52.com/hmrc-export-breaches-2020-to-2025/