- Reg52

- Posts

- Dutch AML -> Rabo due in court

Dutch AML -> Rabo due in court

TD Bank: 41 execs lose/reduced pay due to AML failings

FCC MonWedFri

Good morning ,

Main Story: Rabobank vs Dutch Public Prosecution: It’s on

Enforcement Actions & Fines: TD Bank AML exec pay impact

Regulatory Updates: Crypto Taskforce Roundtable - no mention of Financial Crime

1. Rabobank

🇳🇱 Netherlands | Public Prosecution Service (OM)

No AML settlement agreement, Dutch Prosecution to bring Rabobank AML/CFT case to court (OM)

“There is such a difference of opinion regarding a settlement that the parties have not reached an agreement at this time. We understand that the Public Prosecutor will present the case to the court.”

Rabobank is being summoned to court by the Dutch Public Prosecution for alleged, long-standing AML/CFT violations. This raises two questions for me: why haven’t they settled, and what might the real penalty be.

1.Why haven’t they settled?

The Dutch Prosecution says Rabobank:

Repeatedly broke the Money Laundering and Terrorist Financing (Prevention) Act

Failed to conduct proper customer checks and report unusual transactions from October 2016 to late 2021

Rabobank countered and defended its AML processes, stating it has:

A specialist mgmt board member focussed on Financial Crime: “Chief Financial Economic Crime Officer (CFECO)”

A lot of people working on Financial Crime “Year after year, investments have been made in expanding the number of FEC employees. In 2024, 8,000 employees worldwide worked at FEC-Rabobank”

Enhanced remediation: “Following an instruction from the Dutch Central Bank (DNB) in 2021, Rabobank has enhanced its remediation programme in consultation with DNB”

Centralised the FCC function: “From 2016 in the Netherlands and in 2023 worldwide, activities related to Financial and Economic Crime Prevention (FEC) have been centralized”

Despite a net profit of €5.2bn in 2024, Rabobank hasn’t simply paid a settlement.

It either believes it is not at fault or is worried about personal liability for directors and executives, which has been a thorny issue at other Dutch banks like ABN AMRO and ING…

2.What might the real penalty be?

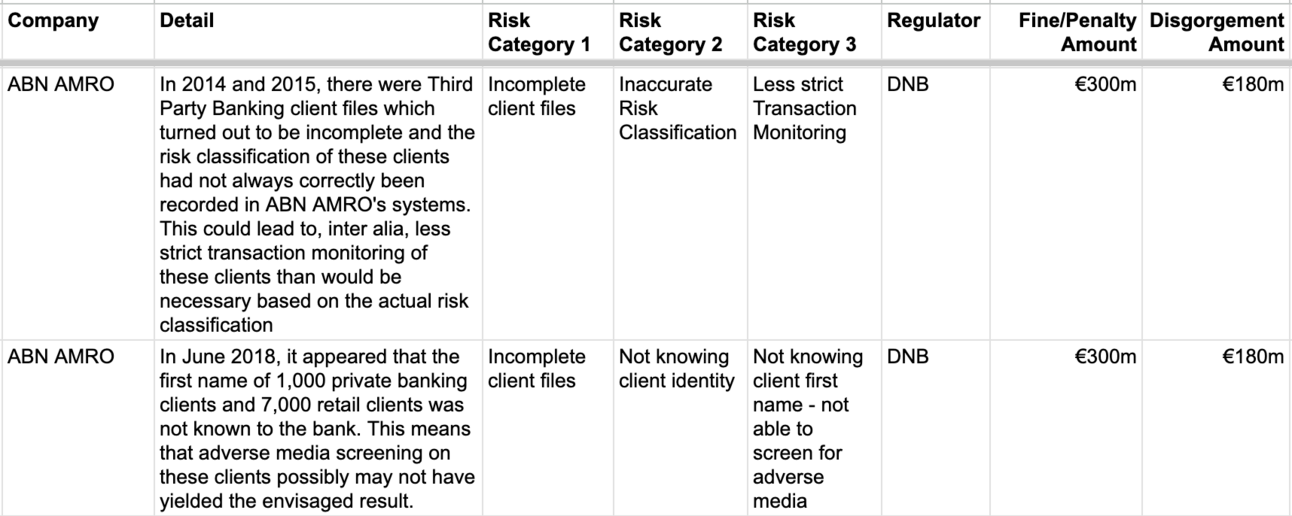

In 2021, ABN AMRO was fined €480m for areas including incomplete client files, weak due diligence, poor risk assessments, insufficient oversight of cash usage, inadequate monitoring, and delays in reporting suspicious transactions and ending high-risk client relationships.

My Enforcement Action Tracker snippet detailing ABN AMRO 2021 fine

€300m penalty and €180m disgorgement (€480m total) - paid in 2021

Personal liability case against ABN AMRO Directors and Key Execs - dropped in Dec 2024 (but that was only after months/years of investigations and “a large number of witnesses” called)

Two potential investor lawsuits against ABN AMRO, Directors and Key Execs - first has asked for legal claims

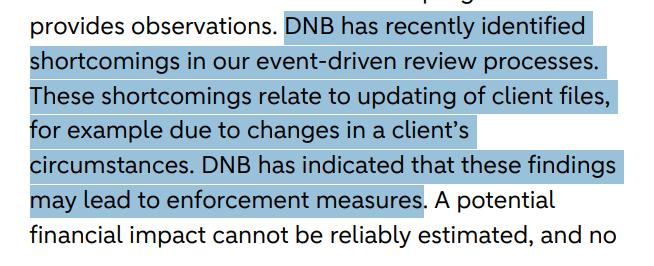

Currently being investigated again:

“DNB has recently identified shortcomings in our event-driven review processes.” their Annual Report says more enforcement action is potentially coming

ABN AMRO Annual Report 2024, pg 134

Against this backdrop, Rabobank may believe its best strategy is to fight back rather than settle.

2. Enforcement Actions, Legal Action & Fines

🇺🇸 United States

TD Bank shared details of pay reductions for their execs due to their AML issues at their annual general meeting last Thursday

Their Chairman revealed that 41 bank execs lost a portion of their variable pay due to the AML failings - totalling $30m in 2023 and 2024

The then CEO, Bharat Masrani, received no cash incentive award or equity compensation for 2024 – an 89% year-over-year reduction to his total compensation

All other members of the Senior Executive Team saw compensation reductions of at least 25% in 2024

3. Regulatory Updates: New FCA tech, KYCompaniesHouse

🇺🇸 United States

At Friday’s SEC Crypto Task Force Roundtable on Trading there was no mention of financial crime from Chair Uleyda or Commissioner Crenshaw in their prepared remarks (SEC)

Have a great week.

Paul