- Reg52

- Posts

- Advising Julius Baer? Look into these actions

Advising Julius Baer? Look into these actions

What's coming next research wise

FCC Insights

Hi ,

The Financial Times reports this morning that FINMA has issued a CHF 4m ($5m) fine to Julius Baer for “failure by Julius Baer, Switzerland’s second-largest listed lender after UBS, to detect or act on suspicious transactions between 2009 and 2019”.

This is according to a FINMA decision notice seen by the Financial TImes.

Currently the FINMA site doesn’t show this notice.

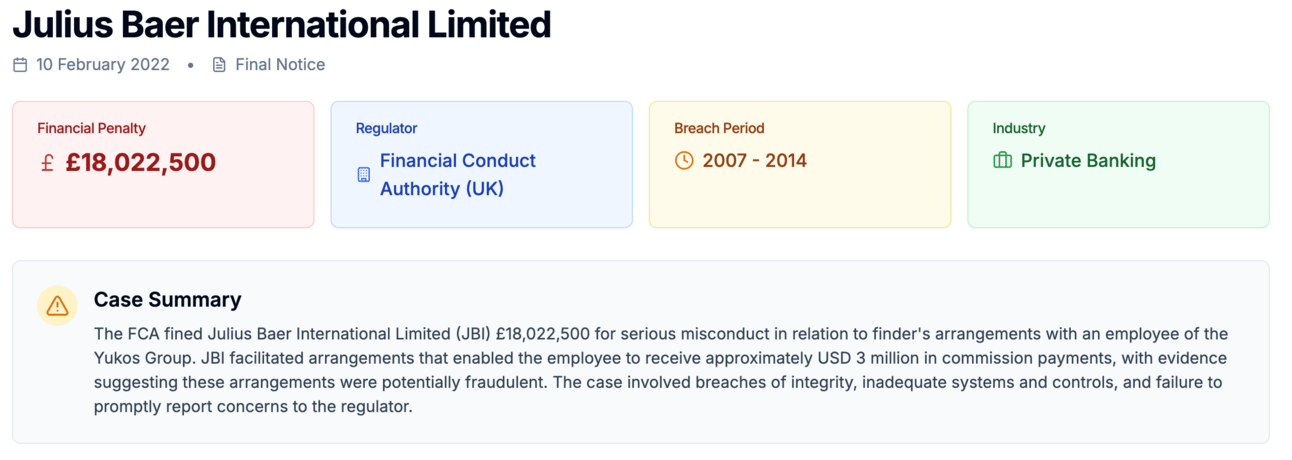

So as we wait, here’s my quick overview (draft, not published yet) of the FCA’s financial crime Enforcement Action and fine against Julius Baer International in 2022.

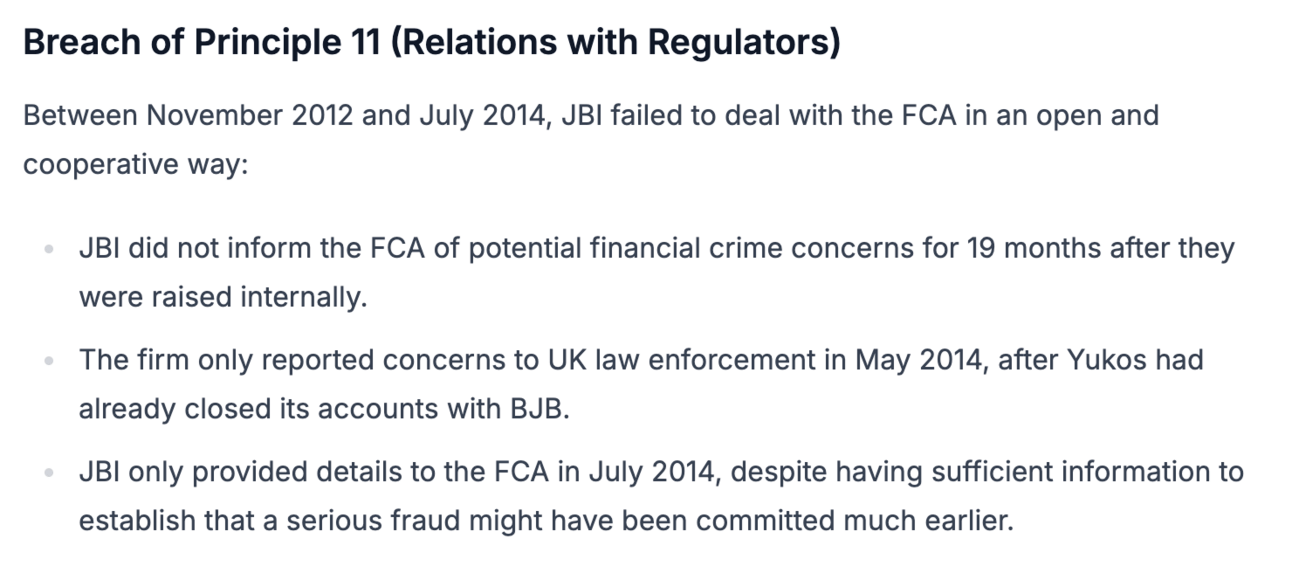

And here’s one of the three major breaches that the FCA called up Julius Baer over:

How could Julius Baer’s board/ExCo/Compliance team/Lawyers & Consultants have avoided this case in the first place?

By consulting Enforcement Actions!

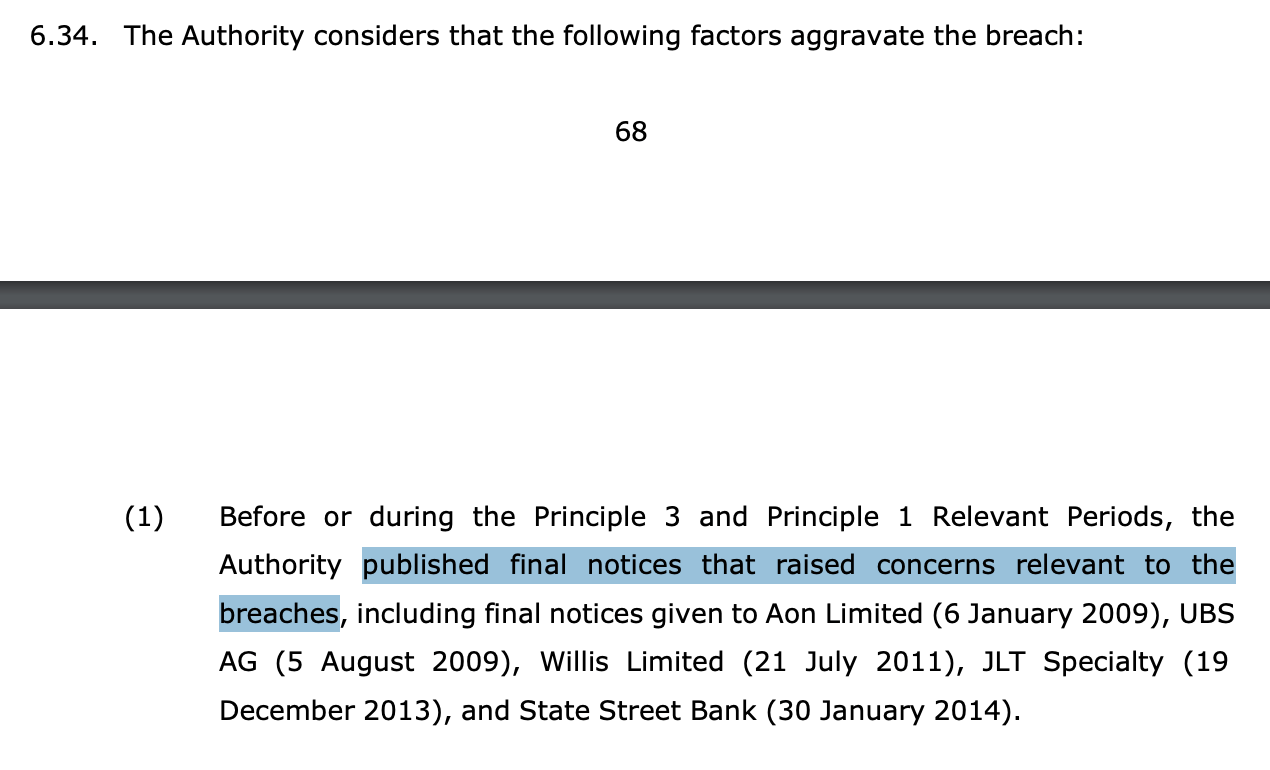

Here’s the primary aggravating factor from the FCA’s 2022 Enforcement Action against Julius Baer International:

Julius Baer and its consultants/lawyers had not been aware of similar enforcement actions (or had been aware and disregarded them).

This is the pain point I’ve set up Reg52 to solve.

The text above highlights three things to me:

The FCA (and other regulators) really want compliance leaders & consultants to pay attention to enforcement actions

The FCA (and other regulators) wants compliance leaders & consultants to see the bigger picture and identify connections across their notices/actions - I will add relevant/similar/related actions* whenever I provide deep-dives

The importance of having a central repository of these actions/notices that are easily findable/categorised/structured

Research priorities

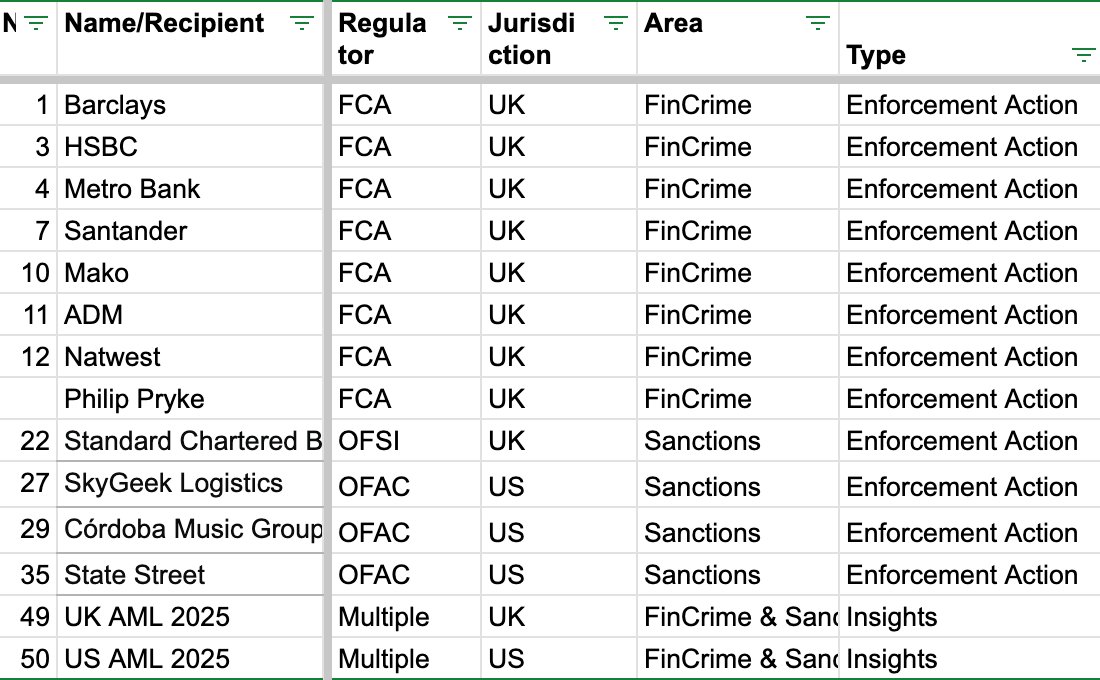

On that note, here my next priorities for research - including Enforcement Action deep-dives and Insights.

I’m happy to add/amend if you have special requests.

Thanks,

Paul

*If helpful, here’s the original docs the FCA highlighted in their 2022 Enforcement Action: